Car accidents can be a nightmare for everyone involved. From the damage to the vehicles to the injuries sustained, everything can add up quickly. One of the biggest concerns after an accident is who is responsible for the medical bills. It’s a complex issue that requires a thorough understanding of the law, insurance policies, and various other factors. In this article, we’ll explore who pays for medical bills in a car accident and what you can do to protect yourself. So, buckle up and let’s get started.

Contents

- Who Pays for Medical Bills in a Car Accident?

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) coverage?

- What is Medical Payments (MedPay) coverage?

- What if the other driver is at fault?

- What if I am at fault for the car accident?

- What if I don’t have car insurance?

- After a car accident, how do my medical bills get paid? Personal injury attorney answers questions

Who Pays for Medical Bills in a Car Accident?

A car accident can happen to anyone, anytime, and anywhere. It can cause physical, emotional, and financial distress to those involved. One of the most significant concerns after a car accident is who will pay for the medical bills. The answer to this question depends on several factors. In this article, we will discuss who pays for medical bills in a car accident and what factors determine the responsible party.

1. Health Insurance

If you have health insurance, it will likely cover your medical bills related to a car accident. However, the extent of coverage will depend on your insurance policy. You may have to pay a deductible, co-payment, or co-insurance, depending on your policy. Some health insurance policies have exclusions for car accidents, so it is essential to review your policy and understand your coverage.

If your health insurance covers your medical bills, it may seek reimbursement from the liable party or their insurance company. This process is known as subrogation, and it allows your health insurance company to recover the money it has paid for your medical bills.

2. Personal Injury Protection (PIP) Insurance

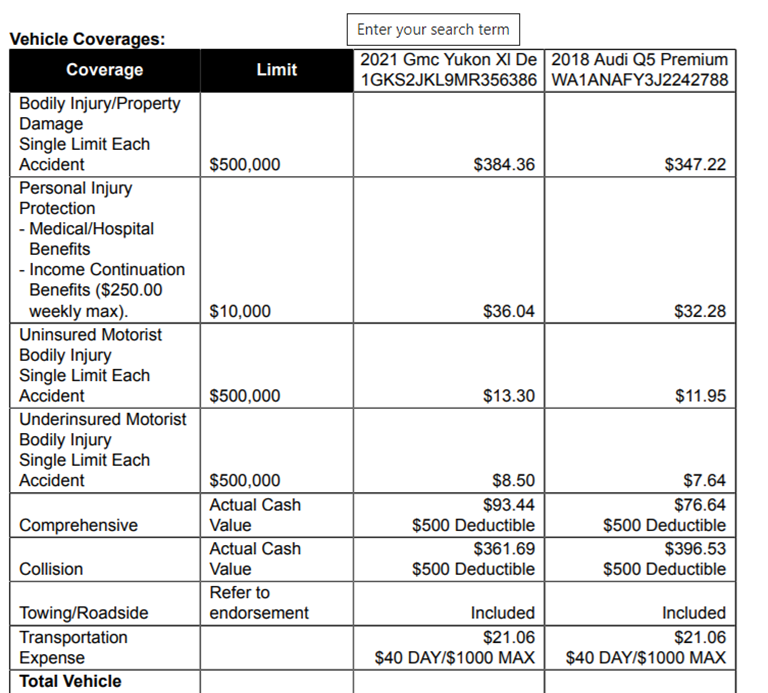

Personal Injury Protection (PIP) insurance is a type of car insurance that covers medical expenses and lost wages for you and your passengers, regardless of who caused the accident. PIP insurance is mandatory in some states and optional in others.

If you have PIP insurance, it will cover your medical bills up to the policy limit. The policy limit varies by state and insurance company. If your medical bills exceed the policy limit, you may have to pay the remaining balance out of pocket or seek compensation from the liable party or their insurance company.

3. MedPay Insurance

MedPay insurance, also known as Medical Payments Coverage, is an optional type of car insurance that covers medical expenses for you and your passengers, regardless of who caused the accident. MedPay insurance is similar to PIP insurance, but it has lower coverage limits.

If you have MedPay insurance, it will cover your medical bills up to the policy limit. The policy limit varies by state and insurance company. If your medical bills exceed the policy limit, you may have to pay the remaining balance out of pocket or seek compensation from the liable party or their insurance company.

4. Liability Insurance

If you were not at fault for the car accident, the liable party’s liability insurance will likely cover your medical bills. Liability insurance is a mandatory type of car insurance that covers damages and injuries caused by the insured driver to others.

If the liable party’s liability insurance covers your medical bills, you may not have to pay anything out of pocket. However, if your medical bills exceed the policy limit, you may have to seek compensation from the liable party directly or through legal action.

5. Uninsured/Underinsured Motorist Coverage

If the liable party does not have insurance or has insufficient insurance to cover your medical bills, your uninsured/underinsured motorist coverage will likely cover your medical bills. Uninsured/underinsured motorist coverage is an optional type of car insurance that covers damages and injuries caused by uninsured or underinsured drivers.

If you have uninsured/underinsured motorist coverage, it will cover your medical bills up to the policy limit. The policy limit varies by state and insurance company. If your medical bills exceed the policy limit, you may have to pay the remaining balance out of pocket or seek compensation from the liable party directly or through legal action.

6. Workers’ Compensation

If you were driving for work-related purposes at the time of the car accident, you may be eligible for workers’ compensation benefits. Workers’ compensation is a type of insurance that provides benefits to employees who are injured on the job.

If you are eligible for workers’ compensation benefits, they will cover your medical bills related to the car accident and provide other benefits, such as lost wages and disability benefits.

7. Medicare/Medicaid

If you are eligible for Medicare or Medicaid, they may cover your medical bills related to the car accident. Medicare is a federal health insurance program for people who are 65 or older or have certain disabilities. Medicaid is a state-run program that provides health insurance to people with low incomes.

If Medicare or Medicaid covers your medical bills, they may seek reimbursement from the liable party or their insurance company.

8. Out-of-Pocket

If none of the above options apply to you, you may have to pay your medical bills out of pocket. This can be a significant financial burden, especially if your injuries are severe.

If you have to pay your medical bills out of pocket, you may be able to seek compensation from the liable party or their insurance company through legal action.

9. Benefits of Having Insurance

Having insurance can provide financial protection and peace of mind in the event of a car accident. Insurance can cover your medical bills, lost wages, and other expenses related to the accident.

If you have insurance, you may not have to pay anything out of pocket for your medical bills related to a car accident.

10. Conclusion

In conclusion, who pays for medical bills in a car accident depends on several factors, such as the type of insurance you have, who was at fault for the accident, and the extent of your injuries. If you have health insurance, PIP insurance, MedPay insurance, liability insurance, or uninsured/underinsured motorist coverage, they may cover your medical bills. If none of these options apply to you, you may have to pay your medical bills out of pocket or seek compensation from the liable party or their insurance company through legal action. It is important to review your insurance policy and understand your coverage to ensure that you are adequately protected in the event of a car accident.

Frequently Asked Questions

What is Personal Injury Protection (PIP) coverage?

Personal Injury Protection (PIP) coverage is a type of car insurance that covers medical expenses, lost wages, and other related expenses in case of a car accident. PIP coverage varies by state, but it is mandatory in some states.

PIP coverage is a no-fault insurance, meaning that regardless of who caused the accident, PIP coverage will pay for medical expenses and other related costs up to the policy limits.

What is Medical Payments (MedPay) coverage?

Medical Payments (MedPay) coverage is a type of car insurance that covers medical expenses for you and your passengers in case of a car accident. MedPay coverage is optional in most states, but it is a good idea to add it to your policy if you don’t have health insurance or if you have a high deductible.

MedPay coverage pays for medical expenses up to the policy limits, regardless of who caused the accident. MedPay coverage can be used to pay for co-pays, deductibles, and other out-of-pocket expenses related to medical treatment.

What if the other driver is at fault?

If the other driver is at fault for the car accident, their liability insurance should cover your medical expenses and other related costs. Liability insurance is mandatory in all states, and it pays for damages that the policyholder causes to others.

If the other driver does not have liability insurance or if their policy limits are not enough to cover your medical expenses, you can file a claim with your own insurance company if you have PIP or MedPay coverage. You can also file a lawsuit against the other driver to recover your damages.

What if I am at fault for the car accident?

If you are at fault for the car accident, your liability insurance should cover the other driver’s medical expenses and other related costs. If the other driver has PIP or MedPay coverage, their insurance may cover some of their medical expenses as well.

If your liability insurance limits are not enough to cover the other driver’s damages, they may file a lawsuit against you to recover their damages. It is important to have enough liability insurance to protect your assets in case of a car accident.

What if I don’t have car insurance?

If you don’t have car insurance, you may be personally responsible for paying for your medical expenses and other related costs in case of a car accident. You may also be subject to fines and penalties for driving without insurance.

If you are injured in a car accident and don’t have insurance, you may be able to get medical treatment through other means, such as Medicaid or your own health insurance. However, you may still be responsible for paying for your medical expenses out of pocket.

After a car accident, how do my medical bills get paid? Personal injury attorney answers questions

In conclusion, the question of who pays for medical bills in a car accident can be a complicated one. The answer often depends on the specific circumstances of the accident and the insurance coverage of the involved parties.

However, it is important to remember that in most cases, the at-fault driver’s insurance will be responsible for covering the medical expenses of the other driver and their passengers. This is why it is crucial to ensure that you have adequate insurance coverage in case you are involved in an accident.

If you have been injured in a car accident, it is recommended that you seek the advice of an experienced personal injury attorney who can help you navigate the complex legal and insurance issues involved in these cases. With the right representation, you can ensure that your rights are protected and that you receive the compensation you deserve for your injuries and medical expenses.

Injured? Contact us for a free consultation.