Driving can be a thrilling experience, but it comes with its fair share of risks. One of the most significant risks is getting into an accident. Unfortunately, accidents are not only terrifying and potentially life-threatening but can also lead to increased car insurance rates. Many drivers are left wondering, does your car insurance go up after an accident? In this article, we will explore the factors that determine if your rates will increase, and what you can do to keep your insurance costs low.

Contents

- Does Your Car Insurance Go up After an Accident?

- Frequently Asked Questions

- What factors determine if my car insurance rates will go up after an accident?

- How much will my car insurance rates increase after an accident?

- How long will my car insurance rates stay high after an accident?

- Can I switch insurance companies after an accident to avoid higher rates?

- What can I do to keep my car insurance rates low after an accident?

- How much does your insurance go up after an accident

Does Your Car Insurance Go up After an Accident?

If you have been in a car accident, you may be wondering if your car insurance rates will go up. The answer is not always straightforward, as there are many factors that can affect your car insurance premium. In this article, we will explore the different factors that can cause your car insurance rates to increase after an accident.

At-Fault Accidents

If you are at fault for an accident, your car insurance rates are likely to increase. This is because insurance companies consider you to be a higher risk driver. The amount of the increase will depend on the severity of the accident and the amount of damage that was caused. In some cases, your insurance company may even decide to cancel your policy.

One way to avoid a rate increase after an accident is to have accident forgiveness coverage. This is an optional coverage that some insurance companies offer. With accident forgiveness, your first at-fault accident will not result in a rate increase.

No-Fault Accidents

If you are not at fault for an accident, your car insurance rates should not increase. In this case, the other driver’s insurance company will pay for the damages. However, if you file a claim with your own insurance company, you may be subject to a rate increase. This is because your insurance company may consider you to be a higher risk driver.

Severity of the Accident

The severity of the accident can also affect your car insurance rates. If there was a lot of damage to your car or the other person’s car, your rates are likely to increase. This is because the insurance company will have to pay out a larger sum of money.

If the accident was minor and there was only a small amount of damage, your rates may not increase. Some insurance companies have a threshold for the amount of damage that will result in a rate increase.

Number of Accidents

If you have been in multiple accidents, your car insurance rates are likely to increase. This is because insurance companies consider you to be a higher risk driver. The more accidents you have been in, the more likely it is that you will be involved in another accident.

If you have a history of accidents, you may want to consider a high-risk insurance policy. These policies are designed for drivers who are considered to be high risk. They are typically more expensive than regular car insurance policies.

Location

Your location can also affect your car insurance rates after an accident. If you live in an area with a high rate of accidents, your rates are likely to increase. This is because the insurance company will consider you to be a higher risk driver.

If you move to a different area, your rates may decrease. This is because some areas have a lower rate of accidents than others.

Type of Car

The type of car you drive can also affect your car insurance rates after an accident. If you have a high-end car, your rates are likely to increase. This is because the cost of repairing or replacing a high-end car is much higher than a regular car.

If you have an older car, your rates may not increase as much. This is because the cost of repairing or replacing an older car is typically lower than a newer car.

Benefits of Accident Forgiveness Coverage

Accident forgiveness coverage can be a valuable addition to your car insurance policy. With this coverage, your first at-fault accident will not result in a rate increase. This can save you a lot of money in the long run.

If you are a safe driver and have a good driving record, accident forgiveness coverage may be worth considering. However, keep in mind that this coverage may not be available with all insurance companies.

Benefits of High-Risk Insurance

If you are considered to be a high-risk driver, a high-risk insurance policy may be your best option. These policies are designed for drivers who have a history of accidents or traffic violations.

While high-risk insurance policies are typically more expensive than regular car insurance policies, they can provide you with the coverage you need. This can give you peace of mind knowing that you are protected in the event of an accident.

Final Thoughts

If you have been in a car accident, your car insurance rates may increase. However, the amount of the increase will depend on many different factors. By understanding these factors and how they can affect your rates, you can make an informed decision about your car insurance coverage.

Remember, it is always a good idea to shop around for car insurance quotes. This can help you find the best coverage at the best price.

Frequently Asked Questions

After getting into a car accident, one of the most common questions people ask is whether their insurance rates will go up. Here are some frequently asked questions that can help you understand how an accident can affect your car insurance premiums.

What factors determine if my car insurance rates will go up after an accident?

Several factors can affect whether your car insurance rates will increase after an accident. These factors include:

- The severity of the accident

- Your driving history

- The type of insurance coverage you have

- Your insurance company’s policies

These factors can vary depending on the insurance company, so it’s essential to review your policy and speak to your insurance agent for more information.

How much will my car insurance rates increase after an accident?

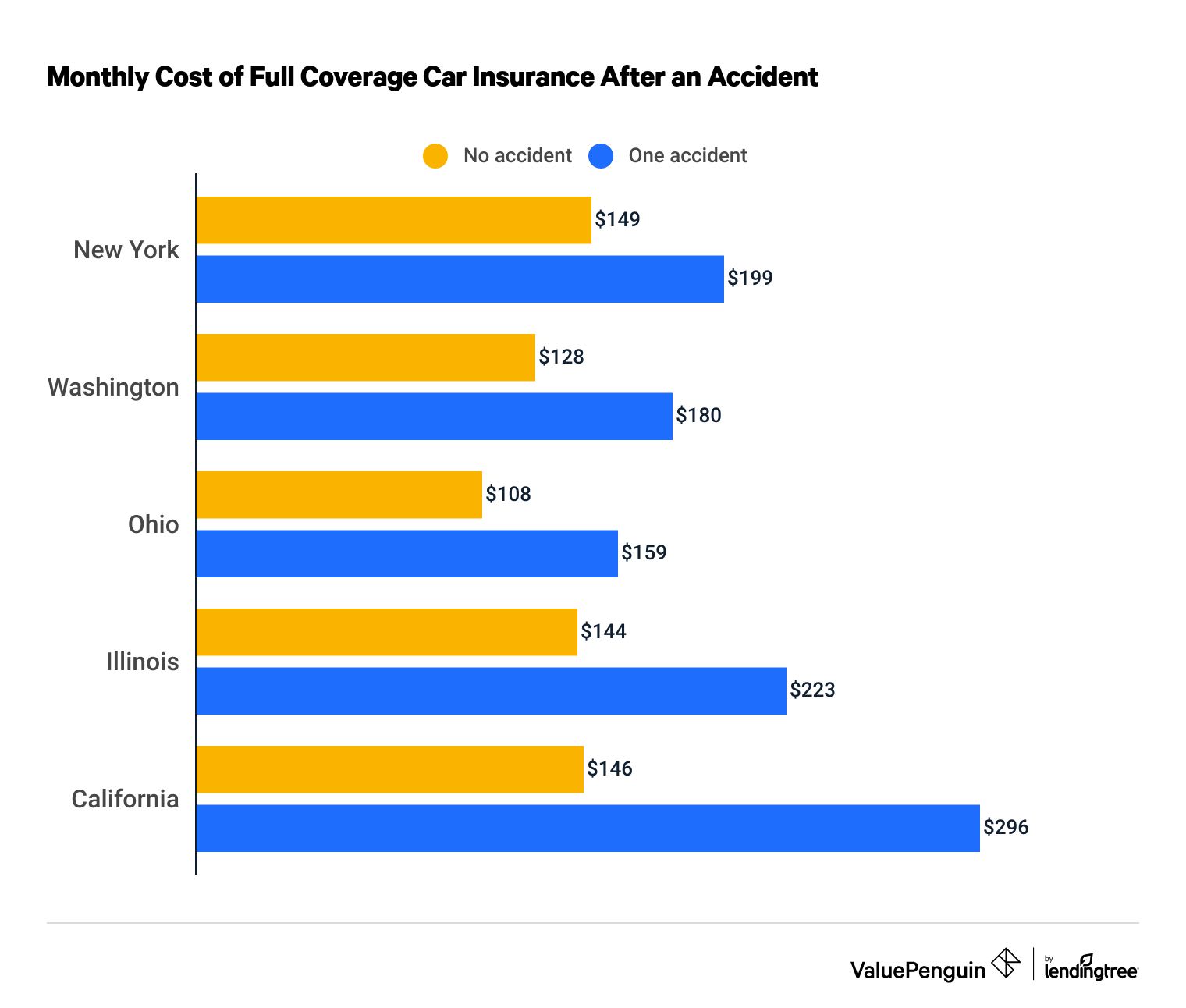

The amount your car insurance rates increase after an accident will depend on several factors. If the accident was your fault and caused significant damage, your rates could increase by up to 50%. However, if the accident was minor and you have a good driving history, your rates may not increase at all. It’s best to contact your insurance company to get a better idea of how much your rates will increase.

How long will my car insurance rates stay high after an accident?

The length of time your car insurance rates will stay high after an accident will vary depending on several factors. In most cases, your rates will increase for three to five years after an accident. However, if you maintain a good driving record during this time, your rates may decrease sooner.

It’s essential to contact your insurance company and discuss your options for reducing your rates after an accident. You may be eligible for discounts or other programs that can help you save money on your premiums.

Can I switch insurance companies after an accident to avoid higher rates?

Yes, you can switch insurance companies after an accident to avoid higher rates. However, it’s essential to keep in mind that your driving history and accident record will follow you to your new insurance company. This means that your rates may still increase, or you may have a harder time finding a company that will offer you coverage.

It’s best to speak to your insurance agent and review your policy before making any decisions about switching insurance companies after an accident.

What can I do to keep my car insurance rates low after an accident?

To keep your car insurance rates low after an accident, you should maintain a good driving record and take advantage of any discounts or programs offered by your insurance company. You may also want to consider increasing your deductible or lowering your coverage limits to reduce your premiums.

It’s essential to contact your insurance company and discuss your options for reducing your rates after an accident. They may be able to offer you discounts or other programs that can help you save money on your premiums.

How much does your insurance go up after an accident

In conclusion, getting into a car accident can be a stressful and challenging experience, especially when it comes to the aftermath of dealing with your car insurance. Unfortunately, in most cases, your car insurance rates will go up after an accident. This is because insurance companies view you as a higher risk driver and want to protect themselves against the possibility of future claims.

However, it’s important to remember that not all accidents will result in a rate increase. If the accident was minor and you were not at fault, it’s possible that your rates may stay the same. Additionally, some insurance companies offer accident forgiveness programs that allow you to avoid a rate increase after your first accident.

Ultimately, the best way to avoid a rate increase is to practice safe driving habits and avoid accidents altogether. But if you do find yourself in a situation where your rates have increased, it’s important to shop around and compare insurance quotes to ensure you’re getting the best possible rate for your coverage needs.

Injured? Contact us for a free consultation.