Bicycling is an enjoyable and healthy activity that has gained popularity in recent years. However, accidents can occur, and it’s essential to have the necessary coverage to protect yourself and your bike. Homeowners insurance is a common type of insurance that many homeowners have, but does it cover bike accidents?

In this article, we will explore the specifics of homeowners insurance coverage and whether or not it extends to bike accidents. We will also take a closer look at what other insurance options are available to bikers to ensure they have the coverage they need in case of an accident. So, if you’re a cyclist or a homeowner, keep reading to find out if your insurance policy has you covered.

Does Homeowners Insurance Cover Bike Accidents?

Bicycling is a popular mode of transportation and recreation, but it also comes with certain risks. If you own a home and a bicycle, you may be wondering whether your homeowners insurance policy covers bike accidents. In this article, we’ll explore what homeowners insurance typically covers and how it relates to bike accidents.

Homeowners Insurance Coverage for Personal Liability

Homeowners insurance policies typically provide coverage for personal liability, which covers you if someone is injured or their property is damaged and you are found to be at fault. This coverage extends beyond your home and can apply to accidents that occur off your property, including bike accidents.

However, there are limitations to this coverage. For example, if you were riding your bike and collided with someone else, your policy would likely only cover the other person’s damages and injuries. Your own injuries and damages would not be covered by your homeowners insurance policy.

Homeowners Insurance Coverage for Property Damage

In addition to personal liability coverage, homeowners insurance policies also typically provide coverage for property damage. This coverage can apply to damage that you cause to someone else’s property, including their bike.

For example, if you accidentally hit someone’s bike with your car and damage it, your homeowners insurance policy may cover the cost of repairing or replacing the bike. However, if you damage your own bike, your homeowners insurance policy would not cover the cost of repairs or replacement.

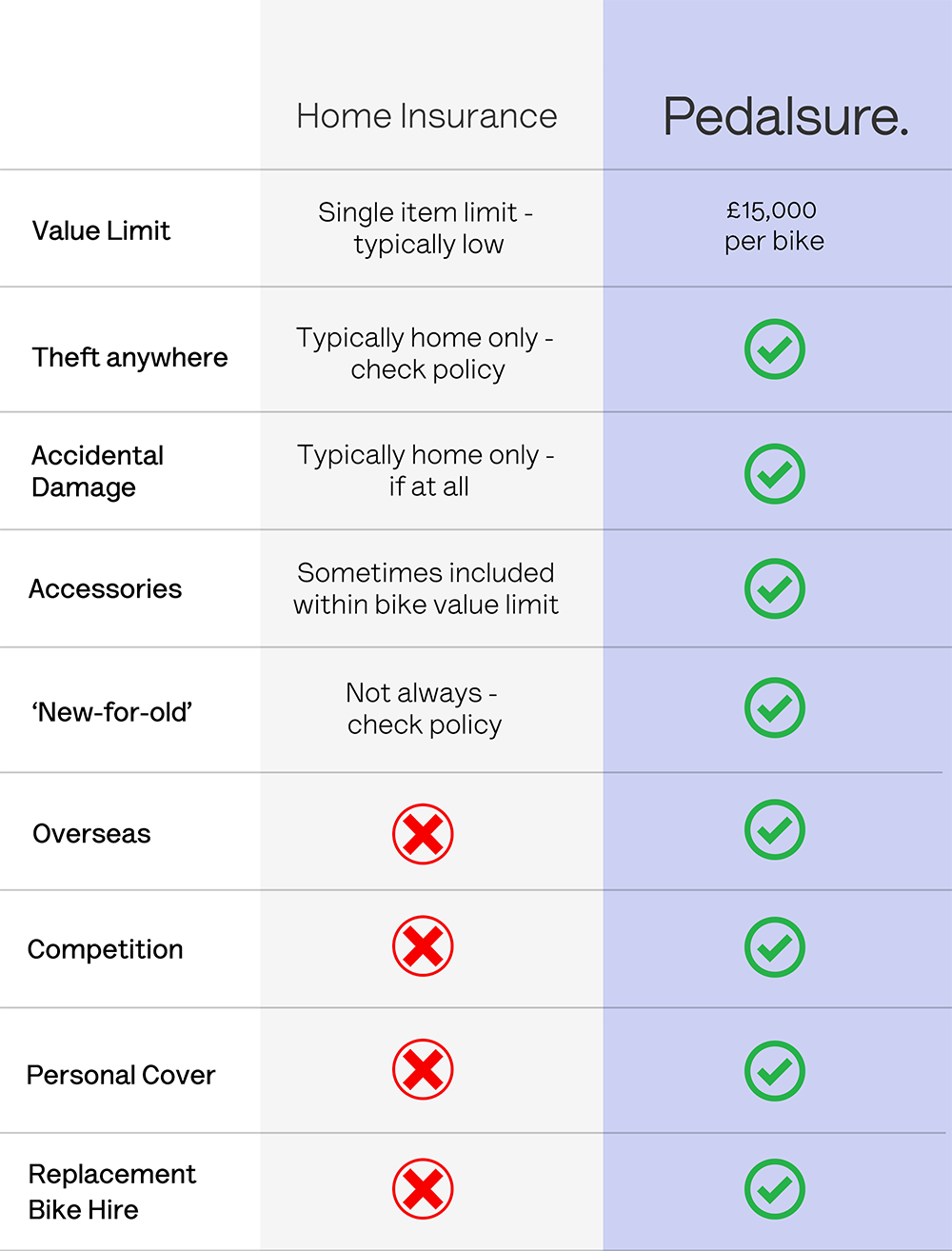

Bike Insurance vs. Homeowners Insurance

While homeowners insurance policies can provide some coverage for bike accidents, it’s important to note that they are not specifically designed to cover bikes. If you own a valuable bike or frequently ride in areas with high risk of accidents, you may want to consider purchasing a separate bike insurance policy.

Bike insurance policies can provide more comprehensive coverage for your bike, including coverage for theft, damage, and liability. They may also have lower deductibles and broader coverage than what is typically offered by homeowners insurance policies.

What to Look for in a Bike Insurance Policy

If you decide to purchase a separate bike insurance policy, there are several factors to consider when choosing a policy. Some things to look for include:

- Coverage for theft and damage

- Coverage for liability

- Low deductibles

- Broad coverage for various types of biking activities

Conclusion

While homeowners insurance policies can provide some coverage for bike accidents, it’s important to understand their limitations and consider purchasing a separate bike insurance policy if you want more comprehensive coverage. Before purchasing any insurance policy, be sure to read the policy documents carefully and understand what is covered and what is not. By doing so, you can ensure that you have the coverage you need to protect yourself and your property in the event of a bike accident.

Frequently Asked Questions

Here are some common questions about homeowners insurance coverage for bike accidents.

What is Covered by Homeowners Insurance for Bike Accidents?

Homeowners insurance may provide coverage for bike accidents, but it depends on the specific policy. Generally, homeowners insurance covers damages to property caused by a bike accident, such as damage to a car or fence. However, it may not cover injuries sustained by the bike rider or other individuals involved in the accident.

It’s important to check with your insurance provider to determine what is covered under your policy and if additional coverage is needed for bike accidents.

Does Homeowners Insurance Cover Stolen Bikes?

Yes, homeowners insurance typically covers stolen bikes. However, the coverage may be limited and subject to a deductible. In addition, some policies may only cover theft if the bike is stolen from the homeowner’s property. It’s important to review your policy and speak with your insurance provider to ensure that your bike is adequately covered.

If you have an expensive bike, you may want to consider adding additional coverage, such as a rider or endorsement, to your homeowners insurance policy.

What is a Bike Rider Liability Endorsement?

A bike rider liability endorsement is an additional coverage that can be added to a homeowners insurance policy. This endorsement provides liability coverage for bike accidents that occur away from the homeowner’s property. It may also cover injuries sustained by the bike rider or other individuals involved in the accident.

This endorsement is especially important for individuals who frequently ride their bikes on public roads or participate in group rides. It’s important to speak with your insurance provider to determine if this coverage is necessary and what the cost will be.

Does Homeowners Insurance Cover Bike Races?

No, homeowners insurance typically does not cover bike races or events. These types of activities are considered higher risk and may require a separate policy or endorsement. If you participate in bike races or events, it’s important to speak with your insurance provider to determine what coverage is needed.

You may need to purchase a separate policy specifically for bike events or consider a personal liability umbrella policy to cover any potential liability claims.

What Should I Do if I am Involved in a Bike Accident?

If you are involved in a bike accident, the first step is to seek medical attention if needed. You should also report the accident to your insurance provider as soon as possible. Document the accident by taking photos of any damages and obtaining contact information from any individuals involved in the accident or witnesses.

It’s important to avoid admitting fault or making any statements that could be used against you later. If you have any questions or concerns about your coverage, contact your insurance provider for guidance and assistance.

What Will Insurance Cover If I Am in a Bicycle Accident?

In conclusion, homeowners insurance can provide coverage for bike accidents, but it largely depends on the specific policy. Some policies may have exclusions or limitations for certain types of accidents, such as those involving bicycles. It is important to review your policy and speak with your insurance agent to fully understand your coverage.

If your policy does cover bike accidents, it can provide peace of mind knowing that you are protected in case of an unfortunate incident. However, it is important to also take steps to prevent accidents from happening in the first place, such as wearing a helmet and following traffic laws.

Overall, while homeowners insurance may not be specifically designed for bike accidents, it can still provide valuable coverage. It is important to review your policy and take necessary precautions to stay safe while riding your bike.

Injured? Contact us for a free consultation.