Have you ever wondered if your car could be considered “totaled” without actually being in an accident? The answer might surprise you. While we often associate the term “totaled” with a car that has been involved in a severe crash, there are other circumstances that could render a vehicle “totaled” as well.

One of these circumstances is known as “constructive total loss,” which occurs when the cost of repairing a vehicle exceeds its total value. In this scenario, an insurance company may choose to declare the car “totaled” and pay the policyholder the actual cash value of the car instead of covering the cost of repairs. Let’s explore this topic further to understand when and why a car may be considered “totaled” without being in an accident.

Can a Car Be Totaled Without Being in an Accident?

If you’re in the market for a new car, you may have heard the term “totaled” thrown around. Typically, when we think of a car being totaled, we assume it’s been in an accident. However, it’s possible for a car to be totaled without ever being in an accident. In this article, we’ll explore the different scenarios that can lead to a car being totaled without an accident.

What Does It Mean for a Car to Be Totaled?

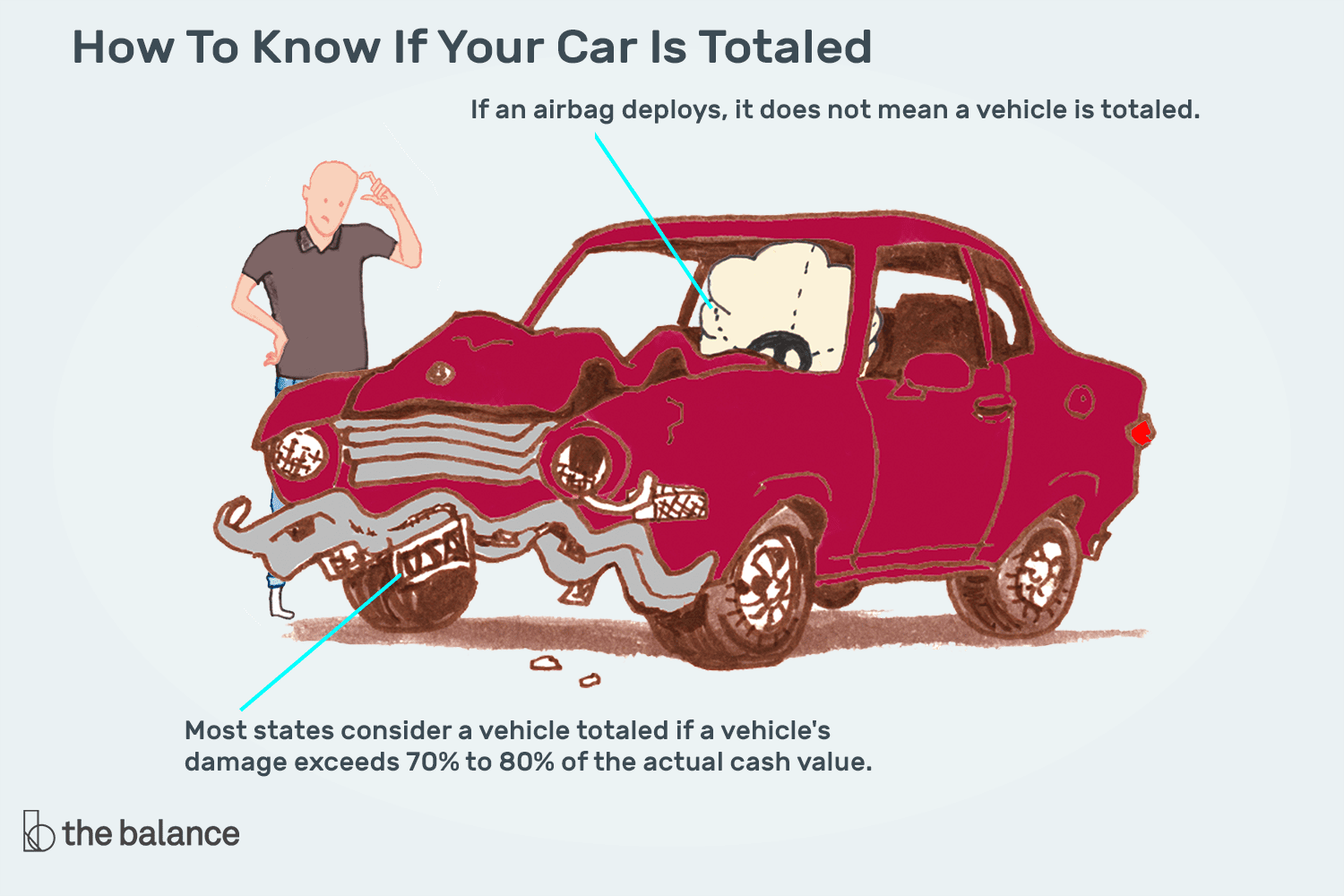

First, let’s define what it means for a car to be totaled. When a car is totaled, it means that the cost of repairing the damage exceeds the value of the car. In other words, it’s more expensive to fix the car than it’s worth. At this point, the insurance company will consider the car a total loss and offer the owner a payout for the value of the car.

Damage from Natural Disasters

One scenario that can lead to a car being totaled without an accident is damage from a natural disaster. For example, if a car is caught in a flood, the water damage can be extensive. In many cases, the cost of repairing the damage is more than the car is worth. Similarly, if a car is hit by a falling tree or other debris during a storm, the damage can be so significant that the car is considered a total loss.

Manufacturer Defects

Another scenario that can result in a totaled car is a manufacturer defect. Sometimes, a part or system in a car can malfunction, causing significant damage to the vehicle. In these cases, the cost of repairing the damage may be more than the value of the car. If the defect is widespread, the manufacturer may issue a recall, but if the damage has already been done to your car, it may be considered a total loss.

What Happens When a Car Is Totaled?

If your car is totaled, the insurance company will typically offer you a payout for the value of the car. The amount you receive will depend on several factors, including the age, make, and model of the car, as well as its condition. If you owe money on the car, the insurance payout will go towards paying off the remaining balance of your loan. If you own the car outright, you can use the payout to purchase a new vehicle.

Benefits of Totaled Cars

While it’s never a good thing to have your car totaled, there are some potential benefits. For one, you’ll receive a payout for the value of the car, which can help you purchase a new vehicle. Additionally, if the damage was caused by a manufacturer defect or other issue outside of your control, you may be able to file a lawsuit to recover additional damages.

Car Totaled Vs. Repaired

When your car is totaled, you’ll need to decide whether to accept the insurance payout or try to have the car repaired. If you choose to have the car repaired, you’ll need to pay for the repairs out of pocket or file a claim with your insurance company. However, if the damage is extensive, it may not be worth repairing the car. In these cases, accepting the insurance payout is typically the best option.

Conclusion

While we typically think of car accidents as the cause of totaled cars, there are several other scenarios that can lead to a total loss. From natural disasters to manufacturer defects, it’s important to know what can cause your car to be totaled. If your car is ever totaled, be sure to consider your options carefully before deciding whether to accept the insurance payout or try to have the car repaired.

Contents

Frequently Asked Questions

What is considered as a car being “totaled”?

When a car is considered “totaled,” it means that the cost of repairing the vehicle is more than the actual value of the car. This usually happens when the damage is extensive, and the car is not safe to drive.

Insurance companies have their own criteria for determining whether a car is totaled or not. In most cases, if the cost of repairing the car is 70-75% of its actual value, the car will be considered totaled.

Can a car be “totaled” without being in an accident?

Yes, a car can be “totaled” without being in an accident. For example, if a car is stolen and then recovered but has suffered significant damage, it may be considered “totaled” by the insurance company. In this case, the cost of repairing the vehicle may be higher than the actual value of the car.

Similarly, a car can be “totaled” due to flood damage or fire damage, even if there was no accident involved. In these cases, the cost of repairing the car can be more than the car’s actual value, leading the insurance company to consider it “totaled.”

What happens when a car is “totaled”?

When a car is considered “totaled,” the insurance company will pay the car owner the actual cash value of the vehicle. The owner can use this money to purchase a new car or repair the damaged car, but it’s usually not worth repairing. The car will be taken to a salvage yard, where it will be sold for parts or scrap metal.

It’s important to note that a “totaled” car will have a salvage title, which means that it has been declared a total loss by an insurance company. This can affect the car’s resale value and make it difficult to sell in the future.

Can a car owner keep a “totaled” car?

Yes, a car owner can keep a “totaled” car, but they will need to buy it back from the insurance company. The insurance company will deduct the salvage value of the car from the payout amount, and the car owner can keep the damaged car.

However, it’s important to note that a “totaled” car may not be safe to drive and may require extensive repairs. It’s usually not worth keeping a “totaled” car, as it can be more expensive to repair than to purchase a new one.

How can a car owner prevent their car from being “totaled”?

The best way to prevent a car from being “totaled” is to drive safely and avoid accidents. Regular maintenance can also prevent minor issues from turning into major problems. Additionally, car owners can opt for comprehensive insurance coverage, which can cover non-accident-related damage such as theft, fire, or flood damage.

In the event of an accident, it’s important to have the car inspected by a reputable mechanic to ensure that all damage is properly documented. This can help the insurance company determine whether the car is “totaled” or not.

Car Crash, Totaled Car, and No Insurance

In conclusion, a car can be totaled without being involved in an accident. It may seem strange, but there are several factors that can cause a car to be deemed a total loss. These can include things like flood damage, fire damage, or even theft.

It’s important to note that if your car is declared a total loss, it doesn’t necessarily mean that it’s completely worthless. Depending on the extent of the damage, you may still be able to salvage parts or sell it for scrap.

If you’re ever in a situation where your car is damaged beyond repair, it’s important to work closely with your insurance company to understand your options. While it may be a frustrating experience, keep in mind that there are ways to move forward and make the best of a difficult situation.

Injured? Contact us for a free consultation.