Car accidents can be a traumatic experience, both physically and emotionally. And when it comes to receiving a settlement for damages, many people wonder if they will have to pay taxes on it. The answer, like many things related to taxes, is not a straightforward one. In this article, we will explore whether or not car accident settlements are taxable and what factors can affect the taxability of the settlement. So, let’s delve into the complex world of car accident settlements and taxes.

Contents

- Are Car Accident Settlements Taxable?

- What is a car accident settlement?

- Is a car accident settlement taxable?

- What is the tax treatment of compensation for physical injuries or sickness?

- What is the tax treatment of compensation for emotional distress?

- What is the tax treatment of punitive damages?

- How do I report a car accident settlement on my tax return?

- What are the benefits of hiring a tax professional?

- Car accident settlements: Taxable vs. Non-taxable compensation

- Frequently Asked Questions

- 1. How are car accident settlements taxed?

- 2. What if I receive a structured settlement?

- 3. What if my settlement includes reimbursement for medical expenses?

- 4. Can I deduct legal fees related to my settlement?

- 5. What if my settlement includes compensation for lost wages?

- Are Car Accident Settlements Taxable? – Spaulding Injury Law

Are Car Accident Settlements Taxable?

Car accidents are a common occurrence that can lead to serious injuries and property damage. If you have been involved in a car accident, you may be wondering if any financial compensation you receive for your damages and injuries is taxable. The answer is not straightforward, as it depends on several factors. In this article, we will explore whether car accident settlements are taxable and under what circumstances.

What is a car accident settlement?

When you are involved in a car accident, you may be eligible for compensation for damages and injuries. This compensation can come from various sources, such as the other driver’s insurance company or your own insurance policy. A car accident settlement is an agreement between you and the responsible party or their insurance company that outlines the terms of your compensation. The settlement can include compensation for medical expenses, property damage, lost wages, and pain and suffering.

Is a car accident settlement taxable?

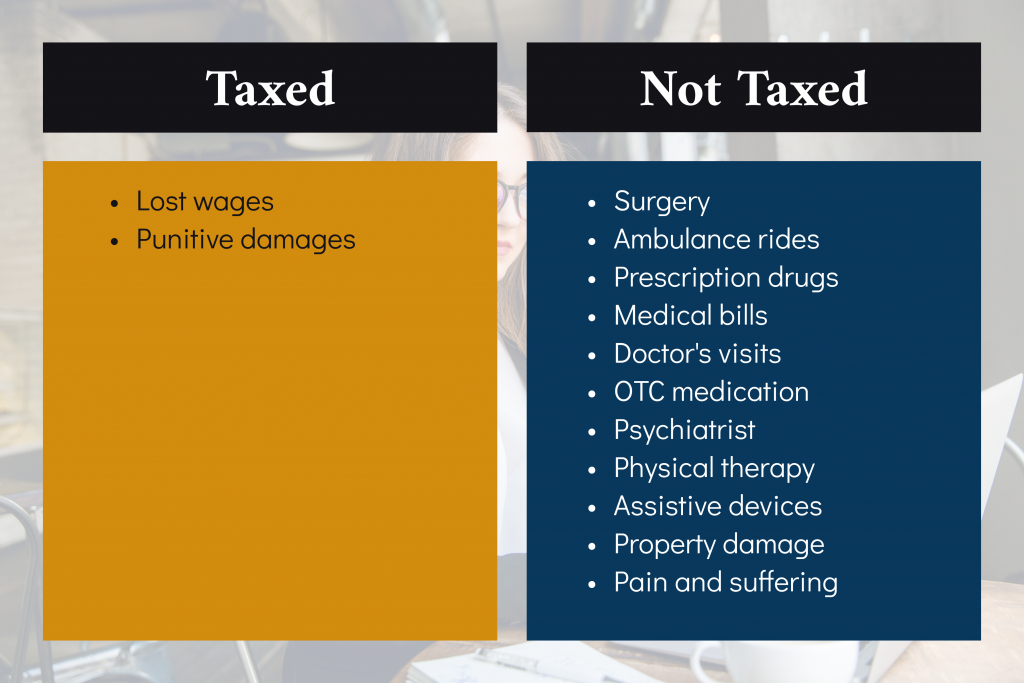

The taxability of a car accident settlement depends on the nature of the compensation you receive. Generally, compensation for physical injuries or sickness is not taxable. This includes compensation for medical expenses, pain and suffering, and lost wages due to the injury. However, if you receive compensation for emotional distress or punitive damages, it may be taxable.

What is the tax treatment of compensation for physical injuries or sickness?

Compensation for physical injuries or sickness is not taxable under most circumstances. This includes compensation for medical expenses, pain and suffering, and lost wages due to the injury. However, there are some exceptions. For example, if you receive compensation for lost wages that you deducted on your tax return in a previous year, you may need to report this compensation as income.

What is the tax treatment of compensation for emotional distress?

Compensation for emotional distress is generally taxable. Emotional distress is a type of compensation that is awarded for non-physical injuries, such as anxiety, depression, and mental anguish. If you receive compensation for emotional distress, you may need to report it as income on your tax return.

What is the tax treatment of punitive damages?

Punitive damages are intended to punish the responsible party for their behavior and deter similar behavior in the future. Punitive damages are generally taxable, as they are not intended to compensate you for your losses. If you receive punitive damages as part of a car accident settlement, you may need to report it as income on your tax return.

How do I report a car accident settlement on my tax return?

If you receive a car accident settlement that includes taxable compensation, you will need to report it on your tax return. You will need to include the compensation as income on your tax return for the year in which you receive it. The compensation will be reported on Form 1040, line 21.

What are the benefits of hiring a tax professional?

If you receive a car accident settlement that includes taxable compensation, it is recommended that you seek the advice of a tax professional. A tax professional can help you understand the tax implications of your settlement and ensure that you report the compensation correctly on your tax return. They can also help you identify any deductions or credits that may be available to you.

Car accident settlements: Taxable vs. Non-taxable compensation

| Taxable Compensation | Non-taxable Compensation |

|---|---|

| Compensation for emotional distress | Compensation for physical injuries or sickness |

| Punitive damages | Compensation for medical expenses |

| Compensation for pain and suffering | |

| Compensation for lost wages due to the injury |

In conclusion, whether a car accident settlement is taxable depends on the nature of the compensation you receive. Compensation for physical injuries or sickness is generally not taxable, while compensation for emotional distress or punitive damages may be taxable. If you receive a car accident settlement that includes taxable compensation, it is recommended that you seek the advice of a tax professional to ensure that you report the compensation correctly on your tax return.

Frequently Asked Questions

Here are some common questions related to car accident settlements and taxes:

1. How are car accident settlements taxed?

Car accident settlements are typically not taxable if they are intended to compensate for physical injuries or property damage. This is because the IRS considers these types of settlements to be “restorative” rather than “income.” However, any portion of a settlement that is meant to compensate for lost wages or other forms of income may be subject to taxes.

It is important to note that settlements for emotional distress or punitive damages are generally taxable. If you are unsure about how your settlement will be taxed, it is best to consult with a tax professional.

2. What if I receive a structured settlement?

A structured settlement is a type of settlement in which payments are made over time instead of all at once. In most cases, the tax treatment of a structured settlement is the same as a lump-sum settlement. However, if the settlement includes interest or other investment income, that portion of the settlement may be taxable.

It is important to review the terms of your structured settlement carefully to determine how it will be taxed. If you have any questions, consult with a tax professional.

3. What if my settlement includes reimbursement for medical expenses?

If your settlement includes reimbursement for medical expenses, that portion of the settlement is generally not taxable. However, if you deducted those expenses on your tax return in a previous year, you may need to include the reimbursement in your income for that year.

It is important to keep good records of your medical expenses and any reimbursements you receive to ensure that you report your income accurately on your tax return.

If you hire an attorney to help you negotiate a settlement, you may be able to deduct the legal fees on your tax return. However, the rules for deducting legal fees can be complex, and not all legal fees are deductible.

If you have questions about whether your legal fees are deductible, consult with a tax professional.

5. What if my settlement includes compensation for lost wages?

If your settlement includes compensation for lost wages or other forms of income, that portion of the settlement may be taxable. You will need to report the income on your tax return for the year in which you receive it.

It is important to keep good records of any lost income and any compensation you receive to ensure that you report your income accurately on your tax return.

Are Car Accident Settlements Taxable? – Spaulding Injury Law

In conclusion, determining whether car accident settlements are taxable can be a complex issue. However, understanding the nature of the settlement is crucial in determining its taxability. Generally, compensation for physical injuries and emotional distress is not taxable, while compensation for lost wages and punitive damages may be taxable.

It is important to consult with a tax professional to ensure that you understand the tax implications of any car accident settlement you receive. By doing so, you can avoid any unpleasant surprises come tax time and ensure that you are in compliance with tax laws.

Overall, while car accident settlements can be a stressful and overwhelming experience, understanding the tax implications can help ease some of the burden and ensure that you receive the maximum benefit from the settlement. Remember to always consult with a tax professional for specific advice and guidance.

Injured? Contact us for a free consultation.