Car accidents can be a stressful and overwhelming experience. In addition to physical injuries and damage to your vehicle, there’s the added headache of dealing with car insurance. After an accident, it can be difficult to know what steps to take next. That’s why we’ve put together this guide to help you navigate the process and ensure that you receive the compensation you deserve.

From reporting the accident to your insurance company to understanding your coverage and filing a claim, we’ll provide you with all the information you need to handle the aftermath of a car accident. So if you’ve been involved in a collision, don’t panic. Read on to learn what to do after car accident insurance and get back on the road to recovery.

Contents

- What to Do After a Car Accident Insurance?

- Frequently Asked Questions

- What should I do immediately after a car accident?

- When should I report the accident to my insurance company?

- What information do I need to provide to my insurance company?

- Will my insurance rates go up if I file a claim?

- What if the other driver doesn’t have insurance?

- Car Insurance Explained, & What to Do After a Car Accident!

What to Do After a Car Accident Insurance?

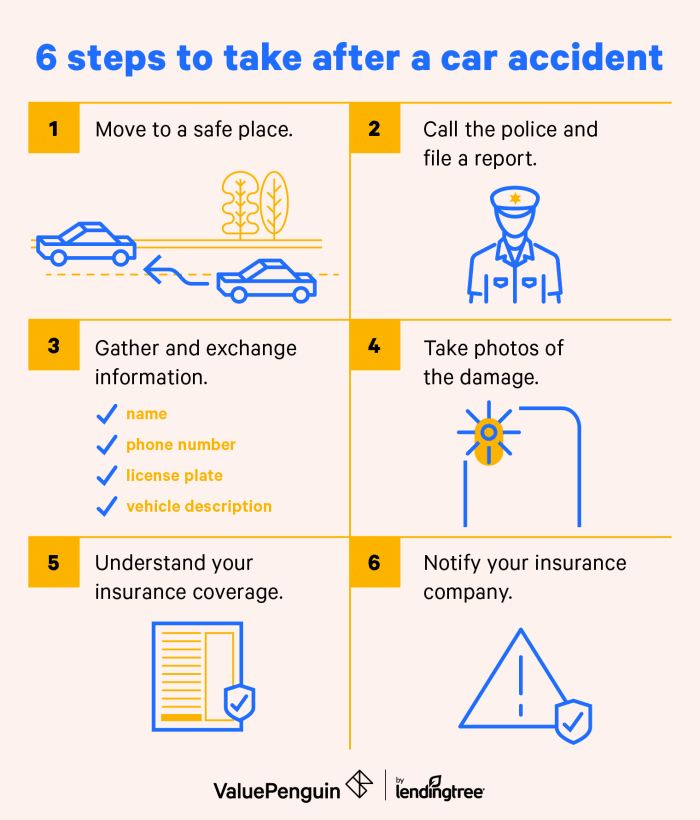

Car accidents can be a traumatic experience, and it can be challenging to know what to do next. However, it’s essential to take the necessary steps after an accident to ensure your safety and protect your insurance claim. Here’s what you need to do after a car accident insurance.

1. Check for Injuries

The first thing to do after a car accident is to check yourself and your passengers for injuries. If anyone is hurt, call for medical assistance immediately. If there are no injuries, move to a safe place, away from traffic, and turn on your hazard lights.

2. Call the Police

Even if there are no injuries, it’s crucial to call the police to report the accident. The police will create an accident report, which is essential for filing an insurance claim. Be sure to provide the police with accurate information about the accident.

3. Exchange Information with the Other Driver

Exchange information with the other driver involved in the accident. This includes their name, phone number, insurance company, and policy number. It’s also essential to get the contact information of any witnesses to the accident.

4. Document the Accident Scene

Take photos of the accident scene, including damage to both vehicles, road conditions, and any traffic signs or signals. This documentation will help your insurance company determine who is at fault for the accident.

5. Contact Your Insurance Company

Contact your insurance company as soon as possible after the accident. Provide them with all the necessary information, including the police report, photos, and witness statements. Your insurance company will guide you through the claims process.

6. Get a Repair Estimate

Get an estimate from an auto repair shop for the damage to your vehicle. It’s essential to get a few estimates to ensure you get a fair price. Your insurance company may require you to use a specific repair shop.

7. Understand Your Coverage

Be sure to understand your insurance coverage and what it includes. This will help you know what to expect from your insurance company and what your out-of-pocket expenses may be.

8. Be Careful with Your Words

When speaking with your insurance company, be careful with your words. Stick to the facts and avoid admitting fault or making statements that could be used against you.

9. Be Patient

The claims process can be lengthy, so be patient. Your insurance company will investigate the accident and determine who is at fault. They will then work with the other driver’s insurance company to resolve the claim.

10. Stay Organized

Keep all documents and records related to the accident organized. This includes the police report, photos, repair estimates, and any correspondence with your insurance company. Having these documents in one place will make the claims process easier.

In conclusion, getting into a car accident is never a pleasant experience, but knowing what to do after the accident can help you protect your insurance claim. Follow these steps, and you’ll be on your way to resolving the claim and getting back on the road.

Frequently Asked Questions

What should I do immediately after a car accident?

After a car accident, it’s important to stay calm and assess the situation. Call 911 or your local emergency services if anyone is injured or if there is significant damage to your vehicle. If it’s safe to do so, move your vehicle to the side of the road or a safe location. Exchange contact and insurance information with the other driver and take photos of the accident scene.

When should I report the accident to my insurance company?

You should report the accident to your insurance company as soon as possible. Even if you don’t think the accident was your fault, it’s important to let your insurance company know what happened. Your insurance company can help you navigate the claims process and may be able to offer assistance with repairs and medical bills.

What information do I need to provide to my insurance company?

You should provide your insurance company with as much information as possible about the accident, including the date, time, and location of the accident, the names and contact information of any other drivers involved, and the names and contact information of any witnesses. You should also provide your insurance company with a detailed description of what happened and any photos or documentation you have.

Will my insurance rates go up if I file a claim?

Filing a claim could potentially cause your insurance rates to go up, but it depends on the circumstances of the accident and your insurance policy. If you were not at fault for the accident, your rates may not increase. However, if you were at fault or if you have a history of accidents or traffic violations, your rates may increase.

What if the other driver doesn’t have insurance?

If the other driver involved in the accident doesn’t have insurance, you may still be able to receive compensation for your damages through your own insurance policy. Uninsured motorist coverage can help cover the costs of repairs and medical bills if you’re hit by a driver who doesn’t have insurance.

Car Insurance Explained, & What to Do After a Car Accident!

In conclusion, getting into a car accident can be a stressful experience, but having proper car insurance can help alleviate some of the financial burden. However, it’s important to know what steps to take after the accident to ensure that you receive the full benefits of your insurance policy.

Firstly, make sure to exchange information with the other driver and any witnesses, and take photos of the damage and the scene of the accident. Secondly, report the accident to your insurance company as soon as possible, and provide them with all the necessary information. Finally, follow up with your insurance company to make sure that your claim is being processed and that you are receiving the coverage you are entitled to.

Remember, even if you have car insurance, it’s still important to be a cautious and responsible driver to avoid accidents in the first place. With these tips in mind, you can navigate the aftermath of a car accident with confidence and ease. Stay safe on the road!

Injured? Contact us for a free consultation.