Car accidents can be a traumatic experience for anyone involved. Not only do you have to deal with the physical and emotional aftermath, but you also have to worry about the financial consequences. One of the biggest questions on your mind might be whether or not you can get insurance after a car accident.

The good news is that, in most cases, you can still get insurance after a car accident. However, there are some important things to keep in mind before you start shopping around for a new policy. Let’s take a closer look at what you need to know.

Contents

- Can I Get Insurance After a Car Accident?

- Frequently Asked Questions

- What is Car Accident Insurance?

- What Happens if I Don’t Have Insurance at the Time of the Accident?

- Can I Get Insurance After a Car Accident?

- What are the Factors That Affect Car Insurance Rates After an Accident?

- What Should I Do if I am in a Car Accident?

- Car Insurance Explained, & What to Do After a Car Accident!

Can I Get Insurance After a Car Accident?

Car accidents can be a traumatic experience, and they can happen to anyone at any time. One of the biggest concerns that people have after an accident is whether they can get insurance coverage. The good news is that, in most cases, you can get insurance after a car accident. However, there are some important things that you need to know to make sure that you get the right coverage and don’t end up paying more than you have to.

Reporting the Accident

The first thing that you need to do after a car accident is to report it to your insurance company. This is crucial because if you don’t report the accident, you may not be able to get coverage for any damages or injuries that you sustained. When you report the accident, make sure that you provide as much information as possible, including the date, time, location, and a detailed description of what happened.

Once you have reported the accident, your insurance company will start an investigation to determine who was at fault. If you were found to be at fault, your insurance rates may go up, but you will still be able to get coverage for any damages or injuries that you sustained.

Filing a Claim

If you were not at fault for the accident, you may be able to file a claim with the other driver’s insurance company. This can be a complicated process, and it is important that you have all of the necessary documentation and evidence to prove that the other driver was at fault.

If you were unable to get the other driver’s insurance information at the scene of the accident, you can still file a claim with your own insurance company. This is known as an uninsured motorist claim, and it can help you get the coverage that you need to pay for any damages or injuries that you sustained.

Getting the Right Coverage

After a car accident, it is important to make sure that you have the right insurance coverage to protect yourself and your assets. One of the most important types of coverage is liability insurance, which will cover any damages or injuries that you cause to other people or their property.

In addition to liability insurance, you may also want to consider getting collision coverage, which will cover any damages to your own vehicle, regardless of who was at fault for the accident. Comprehensive coverage can also be helpful, as it will cover any non-collision-related damage to your vehicle, such as theft or vandalism.

The Benefits of Having Insurance

Having insurance can provide you with peace of mind, knowing that you are protected in the event of an accident. It can also help you avoid financial hardship, as you will not have to pay for any damages or injuries out of pocket.

In addition, many insurance companies offer additional benefits, such as roadside assistance, rental car coverage, and even discounts on your premiums for safe driving habits.

Insurance vs. Out-of-Pocket Expenses

If you do not have insurance coverage, you may be responsible for paying for any damages or injuries that you cause out of pocket. Depending on the severity of the accident, this can be a significant financial burden.

On the other hand, if you have insurance coverage, you will only be responsible for paying your deductible, which is typically much lower than the total cost of the damages or injuries.

The Importance of Shopping Around

When it comes to getting insurance after a car accident, it is important to shop around and compare rates from multiple insurance companies. This can help you get the best coverage at the most affordable price.

In addition, you may also want to consider working with an independent insurance agent, who can help you navigate the complex world of insurance and find the right coverage for your needs.

The Bottom Line

In conclusion, getting insurance after a car accident is possible, but it is important to make sure that you have the right coverage and that you report the accident to your insurance company as soon as possible. By doing so, you can protect yourself and your assets and avoid financial hardship in the event of an accident.

Frequently Asked Questions

What is Car Accident Insurance?

Car accident insurance is a type of insurance that covers the damages caused to a vehicle and its driver and passengers in the event of an accident. This may include medical expenses, property damage, and liability coverage for other drivers or pedestrians involved in the accident.

It is important to have car accident insurance to protect yourself financially from the expenses that arise from an accident. Without insurance, you may be responsible for paying for all damages and expenses out of pocket.

What Happens if I Don’t Have Insurance at the Time of the Accident?

If you do not have insurance at the time of the accident, you may face legal and financial consequences. Depending on the state you live in, you may be required to pay for damages and medical expenses out of pocket. You may also face fines or legal penalties for driving without insurance.

It is important to always have car insurance to protect yourself and others on the road. If you cannot afford insurance, you may be able to find low-income insurance options or other resources in your area.

Can I Get Insurance After a Car Accident?

Yes, you can still get car insurance after a car accident. However, the rates may be higher and the coverage may be limited. Insurance companies may see you as a higher risk driver and charge higher premiums as a result.

It is important to shop around and compare different insurance options to find the best coverage and rates for your needs. Be honest about your accident history and driving record when applying for insurance to avoid any issues in the future.

What are the Factors That Affect Car Insurance Rates After an Accident?

There are several factors that can affect car insurance rates after an accident, including the severity of the accident, who was at fault, and the driver’s insurance history and driving record. Insurance companies may also consider the make and model of the vehicle and the driver’s age and location when determining rates.

To get the best rates after an accident, it is important to maintain a good driving record and consider taking a defensive driving course. It may also be helpful to compare rates from multiple insurance companies to find the best coverage for your needs.

What Should I Do if I am in a Car Accident?

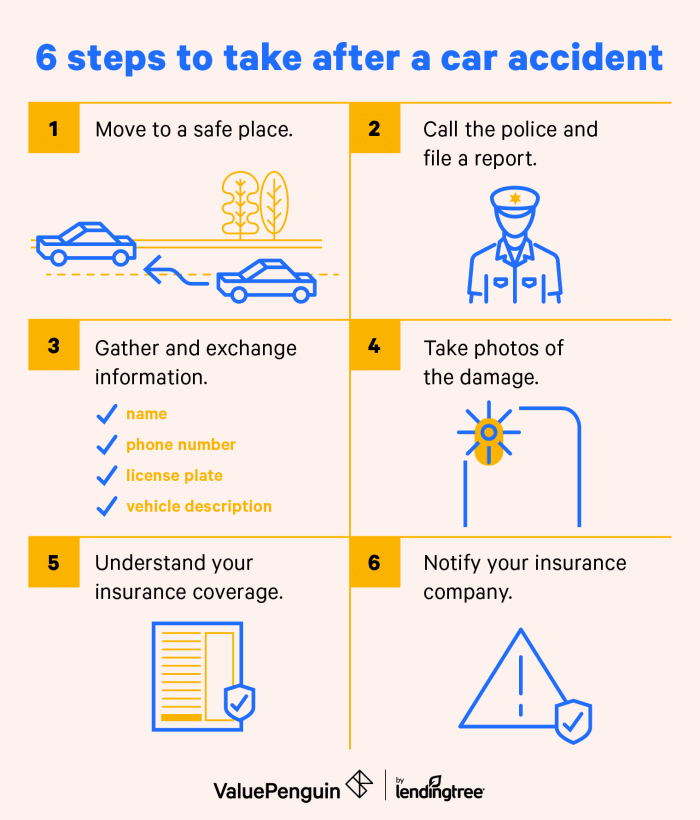

If you are in a car accident, it is important to prioritize your safety and the safety of others involved. Call 911 if anyone is injured and exchange insurance and contact information with the other driver(s). Take photos of the accident scene and any damages to your vehicle.

Report the accident to your insurance company as soon as possible and provide them with any necessary information and documentation. Follow up with your insurance company to ensure that your claim is processed in a timely and efficient manner.

Car Insurance Explained, & What to Do After a Car Accident!

In conclusion, getting insurance after a car accident is possible, but it can be challenging. It’s important to understand that insurance companies will take into consideration the severity of the accident, your driving history, and any previous insurance claims you’ve made.

If you find yourself in this situation, it’s important to be transparent with your insurance company and provide them with all the necessary information they need to make an informed decision. This can include details about the accident, any injuries sustained, and the extent of the damage to your vehicle.

Remember, having insurance is crucial for protecting yourself and others on the road. While it may be difficult to obtain coverage after an accident, it’s important to remain persistent and explore all your options. With the right effort and resources, you can find the insurance coverage you need to get back on the road safely and responsibly.

Injured? Contact us for a free consultation.